Cryptocurrency has gained significant popularity in recent years, attracting both seasoned investors and newcomers to the digital asset world. As the value and adoption of cryptocurrencies continue to grow, it becomes increasingly crucial to prioritize the security of your digital assets. Storing cryptocurrency safely requires implementing best practices and employing various security measures to safeguard your holdings from potential threats. In this article, we will explore the best practices and tips for securely storing your cryptocurrency.

Understand the Different Storage Options

Before diving into the details of cryptocurrency storage, it’s essential to understand the various storage options available. The two primary types of storage are

Hot Wallets

Hot wallets are connected to the internet and are accessible through software applications or online platforms. They offer convenient access to your cryptocurrency holdings but may be susceptible to hacking and online threats. Examples of hot wallets: MetaMask, TrustWallet, Guarda, NOW Wallet. Droidex offers to exchange from such wallets. Safely and at the best exchange rate.

Cold Wallets

Cold wallets, on the other hand, are offline devices specifically designed for storing cryptocurrencies securely. They provide an extra layer of protection by keeping your private keys offline, away from potential cyber threats. Examples of cold wallets: Ledger, Trezor, Ellipal

Utilize Hardware Wallets

One of the most secure methods of storing cryptocurrency is by utilizing hardware wallets. These physical devices store your private keys offline, ensuring they remain protected from online threats. Hardware wallets, such as Ledger and Trezor, offer a user-friendly interface and support a wide range of cryptocurrencies. They employ various security measures, including encryption and two-factor authentication, to prevent unauthorized access.

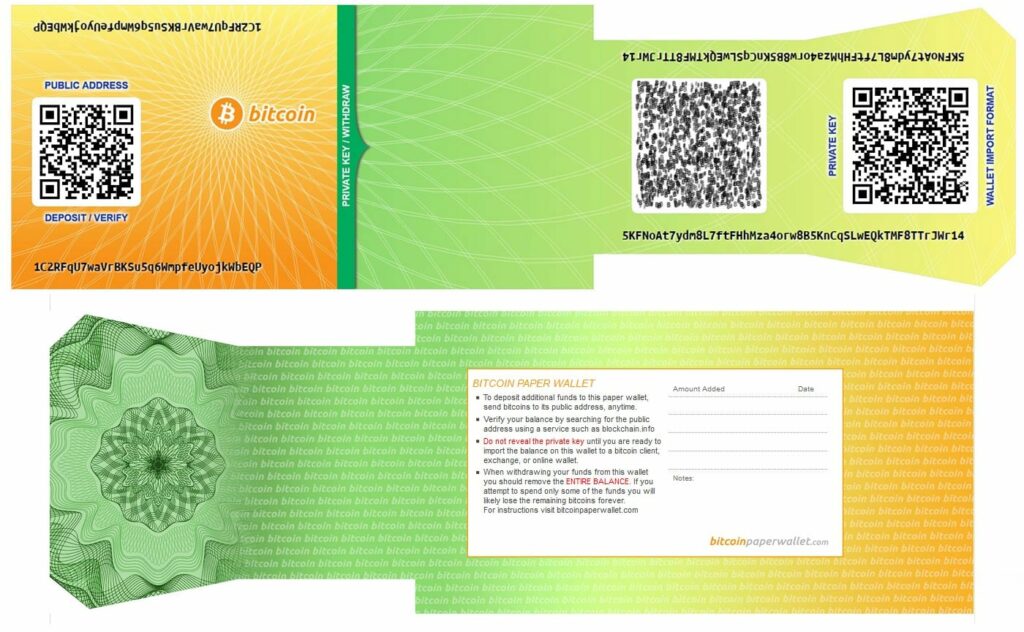

Set Up a Paper Wallet

A paper wallet is a physical document that contains your cryptocurrency’s public and private keys. Creating a paper wallet involves generating these keys offline and printing them on a piece of paper. Since paper wallets are not connected to the internet, they provide a high level of security against online attacks. However, it’s crucial to keep your paper wallet in a safe and secure location to avoid loss or damage.

Enable Two-Factor Authentication

Two-factor authentication (2FA) adds an extra layer of security to your cryptocurrency accounts. By enabling 2FA, you require a second verification method, typically a code generated by an authentication app, in addition to your password. This prevents unauthorized access even if your password is compromised. Many cryptocurrency exchanges and wallets offer 2FA as an option, and it’s highly recommended to enable this feature for enhanced security.

Keep Software and Wallets Updated

Developers regularly release updates and security patches for cryptocurrency wallets and software. It’s crucial to keep your wallets and related software up to date to benefit from the latest security enhancements and bug fixes. Outdated software may contain vulnerabilities that hackers can exploit. Set up automatic updates whenever possible to ensure you’re using the latest and most secure versions.

Implement Strong Passwords

Creating a strong and unique password is essential for protecting your cryptocurrency holdings. Avoid using common passwords or personal information that can be easily guessed. A strong password should be a combination of uppercase and lowercase letters, numbers, and special characters. Consider using a reputable password manager to generate and securely store your passwords.

Backup Your Wallets

Regularly backing up your cryptocurrency wallets is a crucial step in securing your digital assets. Wallet backups protect you against accidental loss, theft, or hardware failure. Hardware wallets often provide a recovery phrase or seed, which is a sequence of words that can be used to restore your wallet in case of loss or damage. Make sure to store your backup in a safe and separate location, preferably offline.

Utilize Multisignature Wallets

Multisignature wallets, often referred to as multisig wallets, require multiple signatures or approvals to authorize transactions. This adds an extra layer of security by distributing control among multiple parties. For example, a 2-of-3 multisig wallet would require two out of three authorized parties to sign off on a transaction. By using multisig wallets, you reduce the risk of a single point of failure and enhance the security of your cryptocurrency holdings.

Be Wary of Phishing Attempts

Phishing is a common method used by hackers to trick individuals into revealing their sensitive information, such as passwords and private keys. Be cautious of unsolicited emails, messages, or websites that ask for your cryptocurrency details. Always double-check the website’s URL, use bookmarks, and enable browser extensions that help detect phishing attempts. Never share your private keys or recovery phrases with anyone.

Diversify Your Storage Approach

It’s wise to adopt a diversified storage approach to minimize risk. Avoid storing all your cryptocurrency holdings in a single wallet or exchange. Distribute your assets across multiple wallets and storage solutions to reduce the impact of a potential security breach or failure. By diversifying, you ensure that even if one storage method is compromised, your entire cryptocurrency portfolio remains protected.

Conclusion

Safely storing your cryptocurrency is of utmost importance in the ever-evolving digital landscape. By implementing the best practices and tips outlined in this article, you can significantly enhance the security of your digital assets. Understand the storage options available, utilize hardware wallets and paper wallets, enable two-factor authentication, keep your software updated, and implement strong passwords. Additionally, backup your wallets, consider using multisignature wallets, stay vigilant against phishing attempts, and adopt a diversified storage approach. By taking these measures, you can confidently protect your cryptocurrency holdings and enjoy the benefits of the digital asset revolution.