We have already written about decentralized finance, but in this article we will talk about decentralized exchanges. The emergence of cryptocurrencies has revolutionized the financial landscape, introducing new possibilities for peer-to-peer transactions. Centralized exchanges have played a vital role in facilitating the trading of cryptocurrencies, but decentralized exchanges (DEXs) have gained significant popularity in recent years. DEXs operate on decentralized platforms, allowing users to trade directly with each other without the need for intermediaries. In this article, we will explore the role of decentralized exchanges in the crypto market and examine their advantages and challenges.

What is Decentralized Exchanges (DEXs)

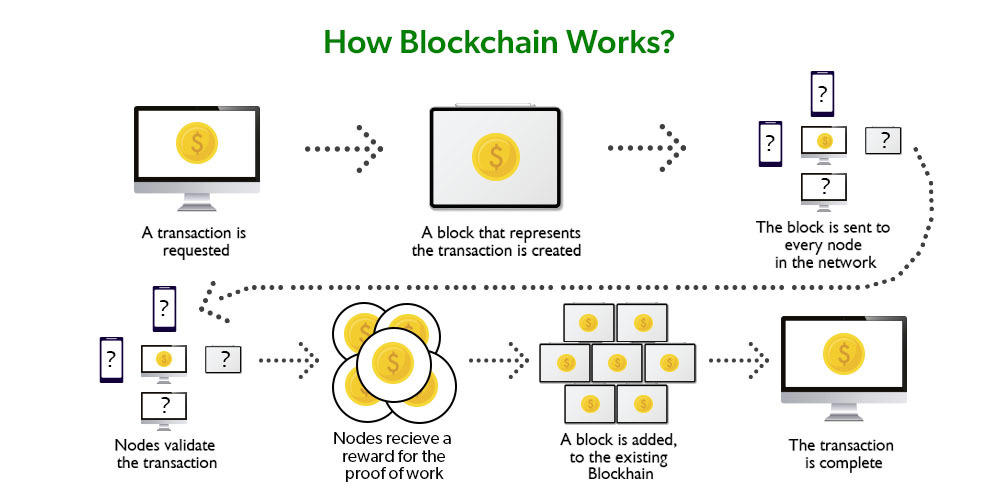

Decentralized exchanges are built on blockchain technology, leveraging the principles of decentralization, immutability, and transparency. Unlike centralized exchanges that act as intermediaries and hold users’ funds, DEXs enable direct peer-to-peer transactions, eliminating the need for a central authority. This decentralized approach offers several advantages, including enhanced security, privacy, and control over assets.

Advantages of DEXs

Security and Trust

One of the key advantages of DEXs is enhanced security. Centralized exchanges are prone to hacking attempts and insider attacks since they store users’ funds on their platforms. In contrast, DEXs allow users to retain control over their funds by utilizing smart contracts and decentralized wallets. This reduces the risk of theft or loss of assets, making DEXs an attractive option for security-conscious traders.

Privacy

Privacy is another crucial aspect provided by DEXs. Traditional exchanges often require users to complete time-consuming verification processes that involve sharing personal information. DEXs, on the other hand, facilitate pseudonymous trading, allowing users to retain their privacy while participating in the market. This aspect aligns with the core principles of cryptocurrencies, promoting financial freedom and anonymity.

Liquidity and Accessibility

DEXs have made significant progress in addressing liquidity issues, which were once a significant concern. The implementation of automated market makers (AMMs) and liquidity pools has greatly improved the liquidity of DEXs. These pools allow users to contribute their funds, which are then used to facilitate trades on the platform. This model incentivizes liquidity providers and ensures a smooth trading experience for users.

Furthermore, DEXs enhance accessibility by eliminating geographic restrictions. Since they are decentralized and accessible from anywhere with an internet connection, individuals from all corners of the globe can participate in the crypto market. This inclusivity expands the potential user base and fosters greater market participation.

Challenges and Limitations

While DEXs offer several advantages, they also face challenges and limitations that need to be addressed for wider adoption.

Scalability

Scalability remains a significant hurdle for DEXs. Most decentralized exchanges are built on public blockchains, which often face scalability issues due to limited transaction throughput. As the number of users and transactions on DEXs continues to grow, the need for scalable solutions becomes paramount. Layer 2 protocols, such as the Lightning Network and sidechains, offer potential solutions by offloading transactions from the main chain and reducing congestion.

User Experience

Improving the user experience of DEXs is crucial for mass adoption. Centralized exchanges often provide user-friendly interfaces and faster transaction speeds compared to DEXs. Enhancements in terms of user interfaces, order execution speed, and reduced gas fees are necessary to make DEXs more appealing to mainstream users. User education and seamless integration with popular wallets and tools can also contribute to a better user experience.

Droidex is one of these DEX exchanges, which provides a nice and clear interface, in addition, to start with us to change the cryptocurrency is easy.

Regulatory Challenges

Regulatory challenges pose another obstacle to the growth of DEXs. As decentralized platforms evolve, regulators around the world are grappling with the appropriate framework to govern these entities. The absence of a central authority makes it difficult to enforce regulatory measures, raising concerns regarding money laundering, fraud, and investor protection. Striking a balance between innovation and regulation is essential to foster the healthy development of DEXs.

The Future of DEXs

Despite the challenges, the role of decentralized exchanges in the crypto market is poised to expand further. As technological advancements address scalability issues and improve user experience, DEXs are likely to attract a broader user base. Furthermore, the growing demand for privacy and security, coupled with the increasing adoption of cryptocurrencies, creates favorable conditions for DEXs to flourish.

Additionally, the integration of decentralized finance (DeFi) protocols with DEXs has added another layer of functionality and utility. Users can now access lending, borrowing, and other financial services directly through DEXs, further enhancing their value proposition.

Conclusion

Decentralized exchanges play a pivotal role in the crypto market by offering enhanced security, privacy, and accessibility. Their decentralized nature aligns with the core principles of cryptocurrencies and fosters financial freedom. While challenges like scalability, user experience, and regulatory hurdles remain, technological advancements and evolving market dynamics are gradually addressing these issues. With the potential to revolutionize the financial landscape, DEXs are poised to shape the future of the crypto market, promoting a more inclusive and decentralized financial ecosystem.

If you want to try for yourself what a decentralized exchange is, then click the button, connect your wallet, which already has cryptocurrency – and go invest!