If you’ve recently plunged into the crypto world, you might be interested to get the answer to the following popular question: is Polygon a good investment? Or, if you’re willing to convert to MATIC, how to do that profitably? Today’s article will reveal all the secrets – we’re going to tell you about the Polygon itself, its key features and price predictions, and, of course, provide you with a detailed step-by-step guide on how to swap tokens to MATIC. So let’s not waste time and get to the point!

What is Polygon (MATIC)?

Let’s start with the basis – what is actually Polygon?

Polygon is one of the most popular scaling solution protocols in the decentralized finance world. It has its own token, MATIC, which is considered one of the world-leading digital assets, along with other giants like Bitcoin (BTC), Ether (ETH), Dogecoin (DOGE), Cardano (ADA), Binance Coin (BNB), and many others. MATIC is used to power transactions on the Polygon protocol, which was launched in October 2017 – it’s a well-structured layer-2 scaling solution platform that allows strengthening the functioning of decentralized finance applications on the Ethereum Network. Moreover, Polygon can also help with infrastructural development.

As for the Polygon’s founders, they’re Sandeep Naiiwal, Anurag Arjun, and Jaynti Kanani. As a whole, Polygon includes The Polygon Team, Polygon Network, and MATIC.

Below you’ll find a table with MATIC’s characteristics:

| Polygon Feature | What for? |

| The modular Polygon SDK – the central component of the Polygon ecosystem | The modular Polygon SDK allows developers to create decentralized applications and any element of network infrastructure. |

| The Polygon supports standalone networks and secure networks | Standalone networks and secure networks are compatible with Ethereum and use a security-as-a-service model. The first networks fit corporate systems and large projects with strong user communities, and the second ones, in turn, provide a high level of security, but at the cost of independence and flexibility. |

| The Polygon architecture | The Polygon architecture includes four abstract and component layers: Ethereum Layer. The first layer is created as a set of smart contracts, which has auxiliary character – Polygon-based networks don’t have to use it.Security Layer. The Security Layer is another additional layer, which can enable the validators-as-a-service model. This function can help to check the validity of any of the system’s networks in exchange for a reward.Polygon Networks Layer. The third layer is the first one among others that is mandatory in the Polygon architecture. It supports transaction matching, local consensus, and block creation thanks to its sovereign blockchains.Execution Layer. The last layer consists of sub-layers of execution environment and execution logic and is responsible for interpreting and executing the transactions included in Polygon blockchains. |

What’s Polygon price prediction?

If we speak about the Polygon price predictions, the situation is as follows: according to the experts, the Polygon price is expected to be at a minimum level of $1.95 in 2022. The MATIC can reach a maximum level of $2.27 with an average trading price of $2.01.

In 2023, the experts expect to see the Polygon price at a minimum level of $2.87, and $3.41 with an average price of $2.95 at a maximum one.

According to the forecast price and technical analysis, the Polygon price in 2024 is expected to reach a minimum level of $4.09. The MATIC price can reach a maximum level of $4.94 with an average trading price of $4.24.

The experts make a deep artificial intelligence-assisted technical analysis of the past price data of Polygon. It means that they’re doing everything possible to collect maximum historical data for the MATIC coin, which includes several parameters, such as past price, Polygon marketcap, Polygon volume, etc. If you’re willing to invest in cryptocurrencies and see a good return on your investments, we recommend you always read such predictions.

So is Polygon a good investment?

Since MATIC is considered the 13th largest digital asset worldwide, as well as continues to remain one of the most popular scaling solution platforms, the majority of crypto experts think the Polygon is a truly good investment, compared to other mainstream cryptocurrencies and decentralized finance (DeFi) tokens. Even though we can see ups and downs in MATICs history sometimes, analysts report that its price might grow exponentially in the long term.

One of the main factors that could impact the investments in MATIC in 2022 is its impressive yearly returns. It’s pretty exciting that MATIC has returned 7,248.69% for holders who sold the cryptocurrency at the right time, isn’t it?

Polygon exchange: why and how?

As we’ve already found out, MATIC is a really good investment, especially if we compare it with many other digital assets. If you’re planning to make a Polygon exchange, we’d like to share with you our small step-by-step guide below that will help you avoid any mistakes and get things right on the first try with the help of our Droidex aggregator:

1.First of all, you need to visit our official website, https://droidex.io/, and press the button “Start Swap”.

2. After that, choose Polygon blockchain.

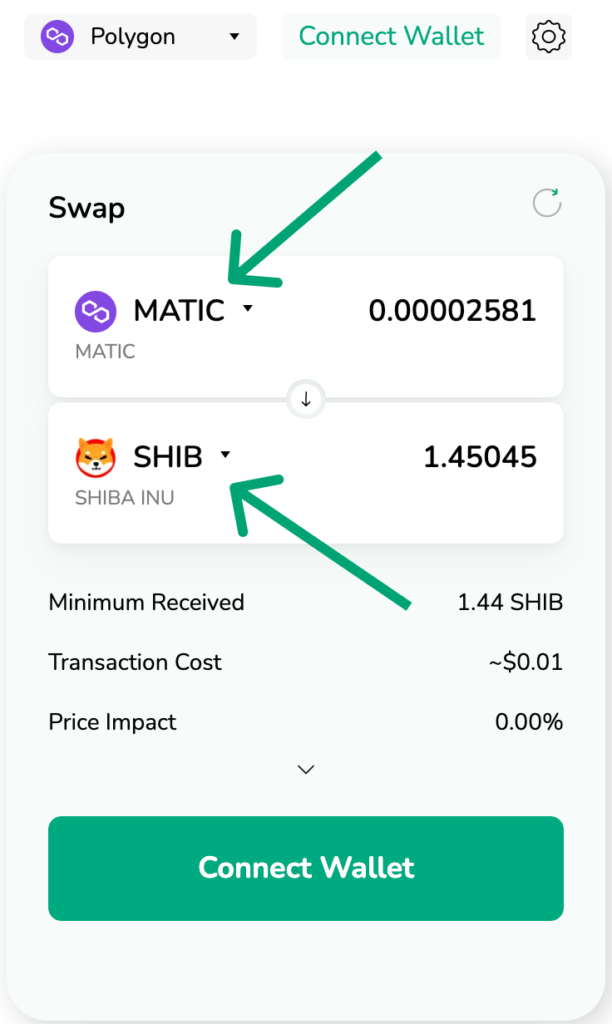

3. Once you’ve chosen the blockchain, select coins – for example, MATIC and SHIB.

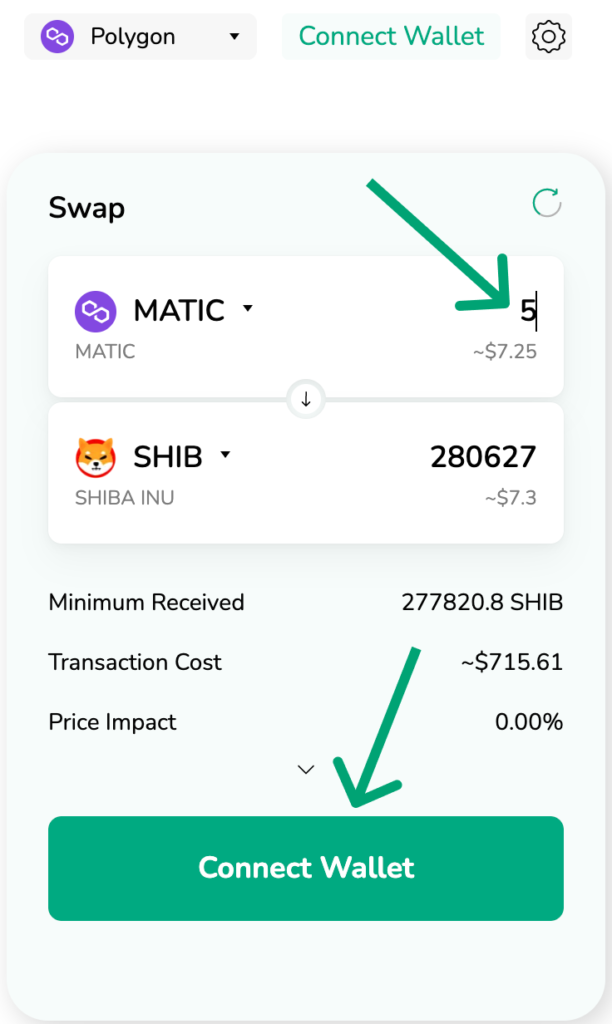

4. Then, enter the number of tokens you want to exchange, for example, 5, and click “Connect Wallet”.

5. Further, choose a wallet – for example, Metamask.

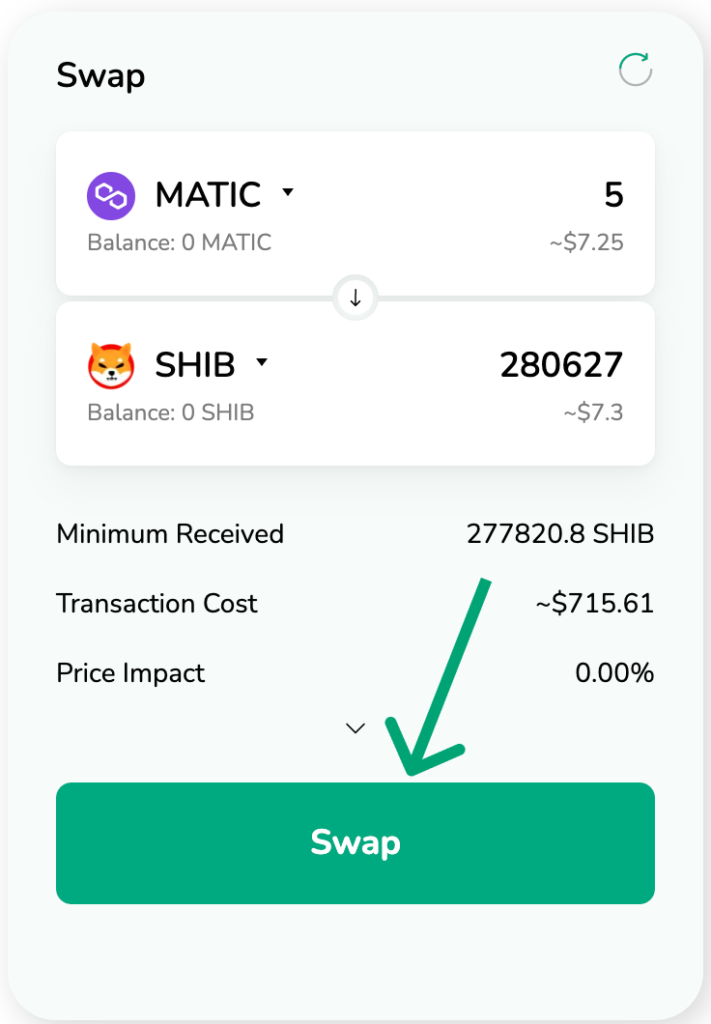

6. Once you’ve chosen the wallet, click “Swap”.

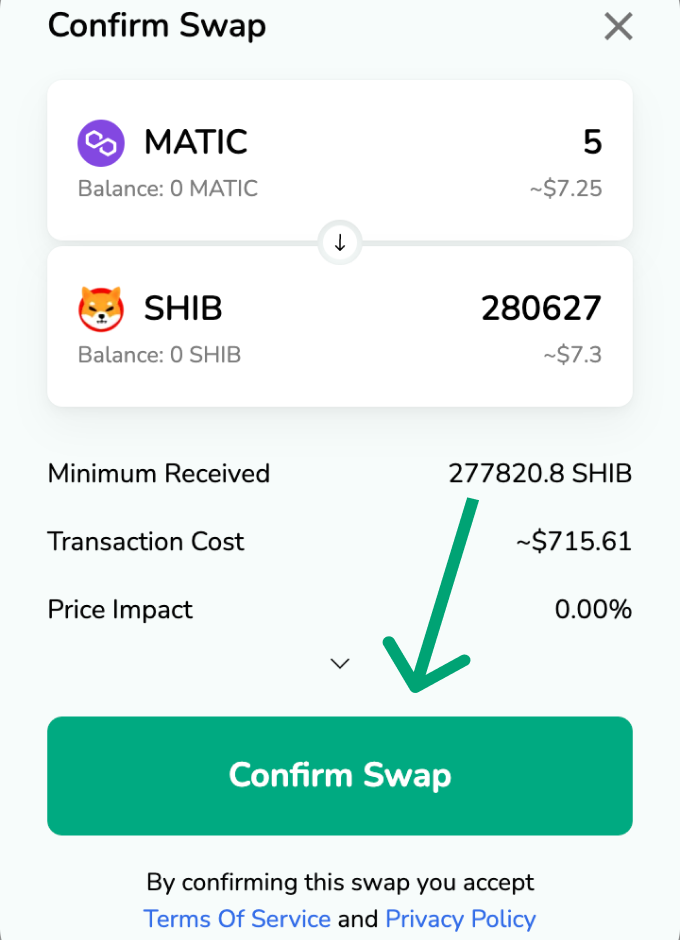

7. Finally, click “Confirm Swap“.

- That’s it! Get your tokens!

In case you want to buy MATIC for fiat, try out Fiatom fiat-to-crypto aggregator that will help you find the best offer on the market completely free of charge.

Conclusion

So how can we answer our key question? Yes, according to the experts and analysts, Polygon is a good investment in both the short and long term. On average, they predict the MATIC will re-test $1.60 in the short term and no more than $30 in the long term. MATIC is an asset of medium capitalization since it falls into the range of at least $2 billion and no more than $10 billion. If it continues to grow, MATIC will be the next big-cap digital asset.